Tax preparation service in San Antonio, TX

Estate tax preparation

We know that tax season one of the most stressful times of the year, and we want to ensure you have the peace of mind to know it’s done right and on time. To complement tax preparation services, we provide several individual and business accounting services to meet all your needs. Free File partner companies may not disclose or use tax return information for purposes other than tax return preparation without your informed and voluntary consent. Your information remains protected from any unauthorized access during its transmission to the IRS. Guaranteed.

Transparency is one of our top priorities. It provides two ways for taxpayers to prepare and file their federal income tax online at no cost. Taxpayers in specific disaster areas are not required to send an extension electronically or on paper. Our professional accountants will accurately prepare and file your taxes on time so you do not need to bear the stress alone.

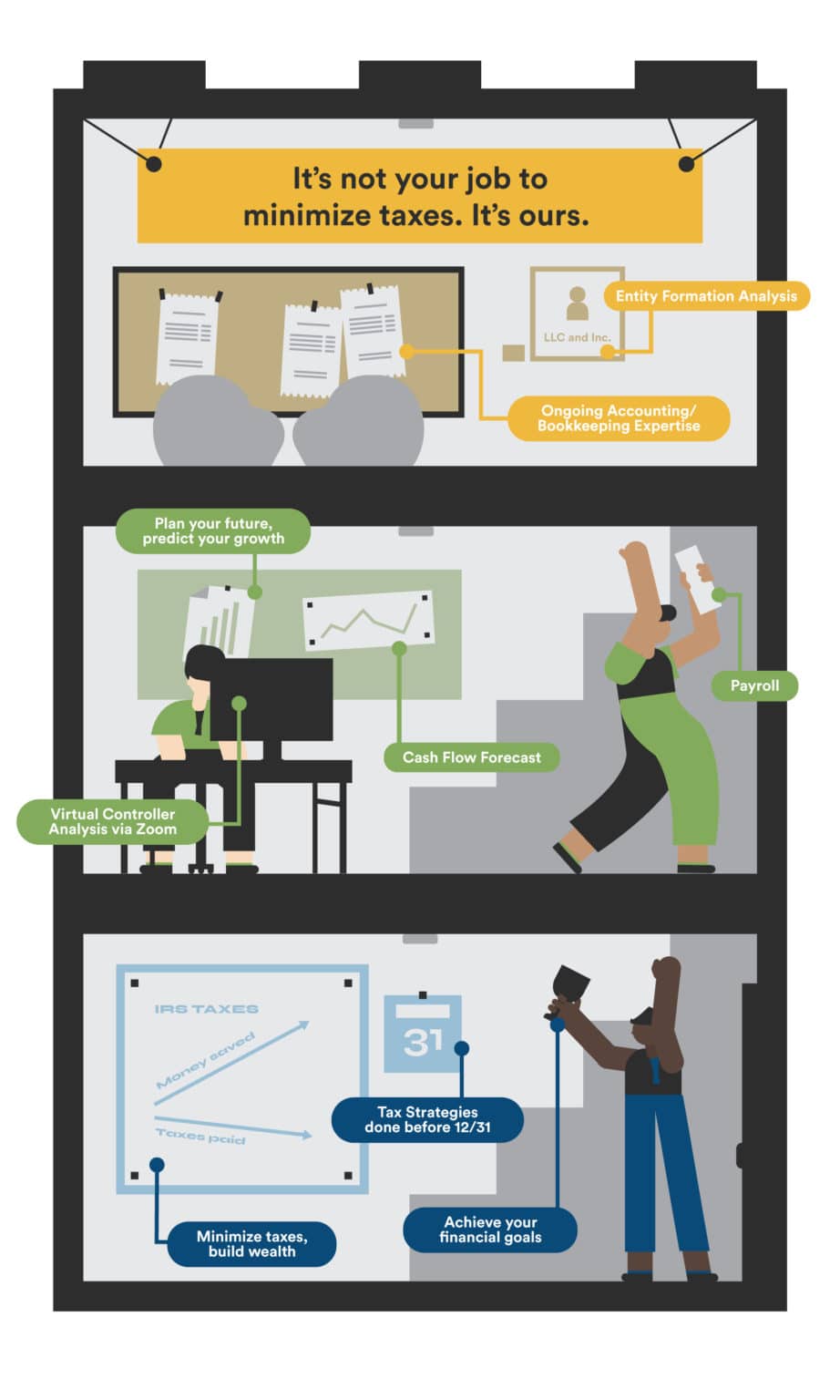

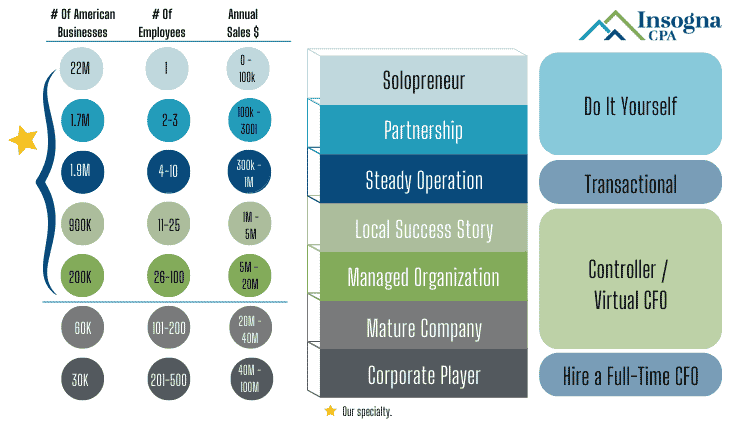

If you're an individual or a small business, we shall help you strategize, prepare, and file your taxes. Tax preparation is time-consuming and sometimes a downright pain. But, how do you become a tax preparer? Need more accounting services to make sure you’re getting the most out of your tax and business situation?

What qualifications are needed? When we handle your taxes for you, an our expert accountants shall prepare them, double-checking them with other members of our team, and digitally filing them for you. Whether your taxes require intricate details or simple and straightforward, finding someone you trust is essential. They must assist their clients in complying with state and federal tax codes, while minimizing the client’s tax burden.

Tax preparation service in San Antonio, TX - flex

- tax accountant

- Investment expenses

- Work opportunity tax credits